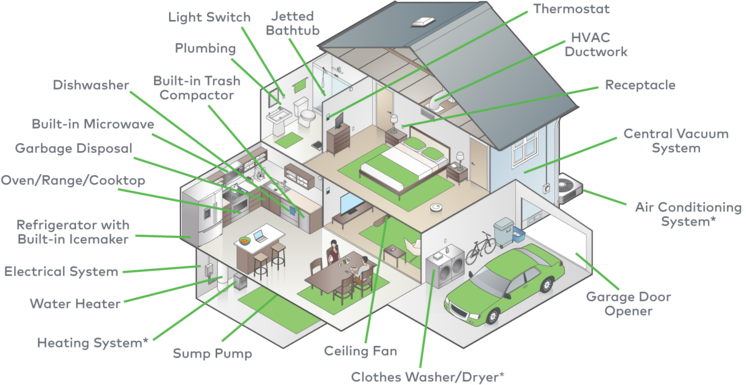

- A home warranty covers home system and appliance repairs, differing from homeowners insurance. It includes major systems but not structural parts or small appliances.

- Home warranties offer savings on repairs and replacements, with regular premiums providing a safety net against high repair costs.

- Home warranties streamline the repair process, providing professional technicians and ensuring efficient service, reducing home maintenance stress.

- Warranties have limitations, not covering cosmetic damages, outdoor items, or certain pre-existing conditions. Review contracts for specific coverage details and company reputation.

A home warranty typically covers major home and kitchen appliances like refrigerators, washing machines, clothes dryers, and dishwashers. They also cover electrical, plumbing, HVAC, gas lines, and more. Depending on the scope of your contract, home warranties can cover costs due to normal wear and tear and replacements in the event of breakdowns or malfunctioning systems. A home warranty does not cover structural elements of a home, such as doors or windows. They don’t cover stand-alone or smaller appliances like electrical fans or toaster ovens.

Purchasing a home warranty can seem costly at the outset, but it makes good financial sense in the long run. Home warranties can translate to significant savings on maintenance, repairs or replacement of appliances and systems that you would otherwise have to pay out of pocket. This is especially true for older appliances and systems or those in older homes. You’ll pay for a home warranty by paying a set monthly or yearly premium, but this cost means you have the security that your systems are covered, even in the case of major breakdowns.

Let’s look closer at the various aspects of home warranties and what they mean for you.

Home Warranty Use Example In Real Life

Imagine you buy and move into a brand new house. The location is great. The neighborhood is pleasant, and the view outside your window every morning is delightful. Everything seems to be in perfect working order — until you step into your second-floor bathroom for the first time, and nothing works. All the other bathrooms are fine, but this one doesn’t seem to have water coming through the bath, shower, or faucets.

If you don’t have a home warranty plan, you’ll have to locate and call a plumber to fix the problem. If the problem turns out to be minor, you’re probably on the hook for a couple hundred dollars. If it ends up being major — for example, repairs require breaking into the bathroom floor to replace a broken pipe or fixture — you could be looking at a bill for several thousand, at least if you don’t have the right home warranty coverage.